Shanghai Auto Show 2019: There will be blood as carmakers fast-track launches or get swept away in uncertain environment

Chinese EV maker Bordrin at the Shanghai Auto Show.

Chinese EV maker Bordrin at the Shanghai Auto Show.

The Shanghai Auto Show opened earlier this week in an uncertain climate for the Chinese new vehicle market. As we have noted in our Q1 2019 update, wholesales of passenger cars in China have now endured 9 consecutive months of year-on-year decline (including 7 straight double-digit drops), a stint unseen since the eighties. Even if March (-6.9%) could signal the light at the end of the tunnel with the first single-digit drop since last August, the market isn’t out of the woods just yet. Adding to these troubled times, the only engine of growth left (electrified vehicles, up 110% YoY in Q1), is about to get hit by halved government subsidies that will make them much dearer to purchase. The stakes have never been that high and unpredictable at the same time, and for manufacturers that want to succeed here it’s either improve at breakneck speed or die. There will be blood.

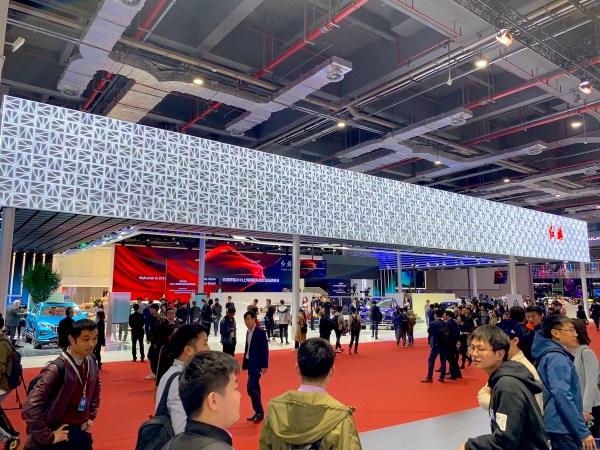

The Shanghai Auto Show is housed in the largest convention centre in the world.

The Shanghai Auto Show is housed in the largest convention centre in the world.

1. The victims

This new reality was overwhelming in Shanghai this week, with a small amount of foreign carmakers tuned to the impossible rhythm of new launches that is required to stay afloat on the Chinese market, but most couldn’t keep pace. As for the Chinese, EV makers that didn’t exist just two years ago are now affording massive stands that are larger than those of much more established foreign manufacturers, but far from seeming out of place it is all very normal as most newcomers have earned the right to stand up to the big guys given the showroom quality of their product. These new arrivals mean that a long list of sluggish local carmakers have been swept away and locked out of the opportunity to exhibit at the show, sometimes also for strategic reasons within an automotive group: ranked by their 2019 sales the list of absentees includes Wuling, Hawtai, SWM, FAW, Lifan, Borgward, Cowin, Karry, Yema, Weichai, Bisu, Neta, Lark, Zhi Dou, Yudo, Link Tour, FQT Motor, Luxgen, Horki, Denza, Fiat, Huasong, Dearcc and Jonway. Don’t be surprised if most of the aforementioned brands have been discontinued by the time the next Shanghai Auto Show opens in 2021.

Chevrolet Tracker, Onix interior detail and Traverse.

Chevrolet Tracker, Onix interior detail and Traverse.

2. The foreigners that got it right

Based on their respective Shanghai showcase, it’s the two most popular groups in China, GM and VW, that appear to be the most in-sync with the extremely demanding Chinese market, a bad omen for the majority of the remaining foreign contingent that was seen panting in comparison. For once General Motors is the most dynamic of all foreign manufacturers present at the Show, with Chevrolet at the top of the list. The American brand showed a completely revamped lineup with only two locally-made nameplates that existed a year ago in Beijing: the Malibu XL and the Equinox. All others, alluring and consistent in an elegant grey robe and sporty Redline streaks, are new: the Onix sedan slots in below the Cruze and features a surprisingly high quality dash, the Monza sedan, the all-new Tracker small SUV, the Trailblazer SUV, the Orlando sporty MPV and the FNR Carryall sporty SUV. There are no concepts on the stand, it’s all down to business now and that’s what we like to see in China. Buick also had some news in the form of an all-new Encore SUV with an extended Encore GX version also showcased.

A new brand is born!

A new brand is born!

The VW Group also rises to the occasion with no less than a new low-cost brand, Jetta, that was launched to the public for the first time in Shanghai. The strong, almost caricatural German accents of the press conference didn’t deter the local media and professional contingent that rushed to examine every inch of the three new models presented: the VA3 sedan and the VS5 and VS7 SUVs. We will cover this momentous event in a separate Strategy article that will focus on the positioning, marketing and potential of the Jetta brand in China, with Volkswagen finding itself in a very similar position to that of Renault at the launch of Dacia in Europe some 15 years ago.

VW ID. Roomzz and Tharu

VW ID. Roomzz and Tharu

Volkswagen introduced the Lavida, Passat and Tiguan L PHEV variants as well as the new generation Sagitar, the Teramont X Coupe SUV and an ID. Roomzz EV concept that we would like to be tantalisingly close to production-ready, but the most striking evolution of the brand compared to the 2018 Beijing Auto Show is its suddenly dominant position on the SUV segment with the new T-Roc, Tharu, Tayron and T-Cross, the latter marking a frank improvement in terms of interior quality – an area that was paradoxically lagging before with the bargain basement Jetta and Bora sedans for example. Improved quality is essential for VW if it wants to create a credible gap with its new low-cost Jetta brand. Market leader in China for the past three decades but seemingly out-of-touch recently, Volkswagen has clawed back at critics and made such progress in the past 12 months that it now seems unattainable all over again.

Hyundai Sonata, ix25, Lexus LM and Nissan Sylphy

Hyundai Sonata, ix25, Lexus LM and Nissan Sylphy

Hyundai also deserves a mention with an all-new, very sharp Sonata looking like a Ford Mustang from the front but a Honda Civic from the back and nested within a dedicated, ultra-luxurious corner of the Hyundai stand, a confronting new ix25 small SUV (what’s with the broken head and tail lights?) and the new Santa Fe just launching in China. The other foreign pillars of the Chinese market that are Toyota (new C-HR and IZOA PHEV, new generation RAV4 and Lexus LM world premiere) and Nissan (all-new Sylphy and Altima) were also shooting novelties fast and furiously but Honda had nothing much new to present apart from a facelifted XR-V crossover.

Lagonda, Lamborghini stands and Mercedes GLB Concept

Lagonda, Lamborghini stands and Mercedes GLB Concept

Depressingly, it was the foreign carmakers that were in most desperate need of a complete rejuvenation that failed to show the goods. Baby steps for Ford (-64% so far in 2019) where a very bland new Escape sat alongside the JMC rebadge called Territory that sported a surprisingly good interior. Renault (-72%) put all its energy on a low-cost Kwid EV that also appeared across the aisle in the… Venucia stand and was at complete odds with the upmarket aspirations of the brand in China symbolised by its Formula 1 association. Where is the much-needed Arkana SUV Coupe? Peugeot (-58%) introduced the 508L, with its wheelbase appropriately extended for the Chinese market but probably too little too late, Citroen (-57%) had only a redesigned C3-XR to show as well as a quirky yet irrelevant AmiOne Concept and DS (-25%) a 3 Crossback way too small for the Chinese market. To end on a high note, we loved the Lagonda Concept at Aston Martin, the always impeccably put together Lamborghini stand featuring my latest fantasy on wheels the Urus, and the oh so Chinese-relevant boxy and off-track-ready GLB Concept by Mercedes.

Geometry stand, A sedan and interior

Geometry stand, A sedan and interior

3. The mainstream Chinese that can keep pace

Leader of the home pack in China for the past two years, Geely has a target on its back with most local manufacturers answering “Geely” when asked who they are competing with. Geely has everything to lose at every Auto Show but somehow always manages to avoid the most dangerous pitfalls. Case in point at Shanghai where the brand unveiled its new EV sub-brand (/brand?) Geometry with a dedicated space and a very impressive new sedan indeed, especially inside. Confusion reigns with regards to the naming however, with the licence plate reading Geometry A but Geely GE11 printed above the taillights. I shall inquire this with the Geely Marketing team shortly. Apart from Geometry, I found the interior quality of some Geely models to be somewhat underwhelming, such as the hot-selling Binyue SUV.

GAC Aion. S and Aion. EX

GAC Aion. S and Aion. EX

The main attraction on the exuberant GAC stand is two new EVs: the Aion. S sedan and Aion. EX SUV, both looking sporty, sophisticated and creative all at the same time which is rather rare for a Chinese manufacturer. The new Trumpchi GS5’s door clomp is Volkswagen-like, but materials and dash are uneven with great steering wheel and seats but a decidedly cheap glovebox opening.

Exeed TXL and Jetour X90

Exeed TXL and Jetour X90

The Chery Group impresses with a new multi brand strategy comprising Chery (new Tiggo 8 seven-seater), the tourism-oriented Jetour whose stand featured real sand and a new X95 large SUV and finally the new upmarket brand Exeed, whose TX large SUV was originally unveiled at the 2017 Frankfurt Auto Show albeit with Chery badges which caused its removal from our Exclusive Chinese Brands Guide. It will now be reinstated.

Baojun RS-5

Baojun RS-5

It should have been a surprise but it wasn’t really, given Baojun has now made a habit of thinking 3 steps ahead: choosing to solely focus on its new logo and upmarket lineup and disregarding its entire “traditional” range (310, 360, 510, 530 and 730) and the Wuling brand, the Baojun stand was at its most expansive ever, clinically white clean with only three vehicles exhibited: two examples of the very impressive RS-5 and one sleek SUV concept. Such balls! However the rest of the huge SAIC hall was a letdown, especially compared to the feverish activity across the aisle at its joint-venture partners Chevrolet and to a lesser extent Buick: a slow trickle of new models (the Roewe Max is nothing but a prepped up RX8) which SAIC tried to mask with a peppering of 20th century heritage MG roadsters – of very good taste truth be told.

Hongqi stand, H5 Sports and HS7

Hongqi stand, H5 Sports and HS7

A big surprise was the absence of any FAW stand but only Bestune and Hongqi stands (two FAW Group brands) set in completely different halls, in a replay of the elimination of the Great Wall stand to the benefit of Haval at the 2014 Beijing Auto Show. I will unpack this mystery during an exclusive interview with FAW Group’s Marketing team that will be published shortly. Bestune only had the hit T77 on its stand but will launch 3 new SUVs within the next 12 months, while Hongqi strikes while the iron is hot (record 13.000 sales in Q1) with the new HS5 and HS7 SUVs that were dealership-ready, a sexy af H5 Sports in fluorescent yellow all of which exhibited in a humongous Hongqi stand.

Changan CS75 Plus

Changan CS75 Plus

Just looking down at the edge of the cliff is Changan with its recently-launched CS35 Plus offering an excellent, full-bodied door clomp and electric seats and the all-new C75 Plus showcasing an impressive dash, but the brand lacked a je ne sais quoi of excitement. New offshoot COS was dedicated a separate full blown stand in a different hall than Changan and exhibited a flurry of new models but its poor sales performance hung a heavy question mark above its presence in Beijing 2020.

Haval F7X and Ora R1 interior

Haval F7X and Ora R1 interior

Haval used to be the standalone star in previous Chinese Auto Shows (we elected it #1 most impressive Chinese brand at Beijing 2014 and Shanghai 2015), but the times of filling its stand with new models are over, with the brand now concentrating on the far less sexy but significantly more profitable business of actually selling cars (+14% in 2019). As a result, new launches are rarer but far more astute such as the F7X Coupe SUV presented at the Show. More surprising was the return of the Great Wall brand next to Haval in order to unveil a very uninspired new pickup. As for the Group’s Ora EV brand which is starting to gain traction (7.000 wholesales in March), bright coloured vehicles and a mock flower shop couldn’t quite mask the fact that the R1 mini hatch is a copy of the Smart Forfour with sugar-sweet interiors that show a glaring lack of quality or sophistication. The more daring iQ was nowhere to be seen.

Lynk & Co stand and Zotye A16

Lynk & Co stand and Zotye A16

Lynk & Co, the revelation of the 2017 Guangzhou Auto Show, presented PHEV variants of its entire lineup (01, 02 and 03) as well as a… trampoline, definitely staying on-brand. Infamous for copycats, Zotye is taking the right direction with its new A16 and B21 SUVs: albeit very akward, they at least have their own design. Leopaard debuted a new logo and the Coupe SUV which looks like a cheap Lamborghini Urus (a young SAIC designer checking the car seemed to think this was a good thing) but although its interior design is sexy the material quality isn’t up to par. Disappointments were BAIC, Brilliance, Dongfeng despite a trendy-looking Aelous EV sedan, Dorcen, Haima, Hanteng, JAC, Landwind and Soueast.

Aiways U5 and its boutique glovebox

Aiways U5 and its boutique glovebox

4. The EV Chinese that punched above their weight

The era of outlandish and unrealistic concept cars with locked doors and blacked-out interiors is over for the multitude of new Chinese EV manufacturers that have sprung up in recent years. It’s now down to business with models that must be ready to sell and open to the media and/or public eye in their most minute details and advanced digital functionalities in order to gain credibility and (ultimately) secure more funding to keep growing. A handful of Chinese EV makers stood out from the crowd in Shanghai. Among them, Aiways cracked its U5 SUV open to the public and what a marvel this is, complete with hidden door handles, suede material on the dash and an impossibly uber-luxurious glovebox.

Li One and interior, Xpeng G3

Li One and interior, Xpeng G3

Li showed a surprisingly understated interior for its One SUV with the obligatory digital screen dash spanning the entire width of the vehicle. Xpeng is open for business with a large stand and a sturdy-looking G3 crossover seemingly ready for some off-the-beaten tracks adventures.

Enovate ME7 and charging station

Enovate ME7 and charging station

Enovate’s ME7 was placarded in huge billboards on the Convention Centre building, securing a spot among the biggest exhibitors at the show and showcasing an impressive mobile interface/charging station (pictured above) even though the car’s door clomp was a little on the light and cheap side.

Weltmeister stand, EX5 detail and EX6 Limited

Weltmeister stand, EX5 detail and EX6 Limited

Weltmeister had a playful shot at the higher-end EV game with the hidden handles and uncluttered looks of the EX5 (already in market), but also showed its eagerness to fast expand its lineup with the EX5 Pro, EX6 Limited and Evolve Concept, all showcased in an oversized stand. Iconiq showed a much more advanced version of its luxury MPV (SPV) concept due in market in 2021 and Qiantu confirmed it is here to stay with two examples of its K50 supercar and an expanded concept lineup of 5 models.

Nio stand, Nomi and ES6

Nio stand, Nomi and ES6

Replicating its outstanding performance at the 2018 Beijing Auto Show, Nio showed 6 new ES6 and 3 ES8 on a massive stand. The brand is in more advanced stages of development than the ones mentioned above so expectations are stronger. Nio is doing everything right with the product (the Nomi AI assistant returns in the ES6) but the main question is how long can the company keep burning cash and will it eventually succeed? It wasn’t the main attraction of the Shanghai Auto Show, demonstrating how much it takes to keep under the spotlight in China.

Hozon U Concept and Bordrin EV7 Concept

Hozon U Concept and Bordrin EV7 Concept

Bordrin sent us mixed signals with on one hand a sumptuous large SUV Concept called EV7 reminiscent of what a futuristic Range Rover should look like, but instead focusing its press conference on the launch of a copycat of the Tesla Model Y named iV6. Why? The jury is still out for Hozon with its new U Concept, the newly renamed Seres SF5 (ex SF Motors), newcomer Grove Hydrogen Automotive, Gyon with a mysterious “no info” stand and Singulato with a great-looking sportscar exhibited in a ghost space with not a single staff.

Tesla Model 3

Tesla Model 3

5. What about Tesla?

Much ink has been spent describing how Tesla is about to take the Chinese market by storm with an upcoming local factory. Well to be fair and to put things in perspective, after having experienced all the Chinese EV goodness above, sitting inside the superstar of our Europe March 2019 sales reports, the Tesla Model 3, feels disappointingly mundane. Its bare, wooden dashboard, removable boxes in the central console and stuck-on touch screen almost likening it to the Ikea of EVs.

This concludes our hits and misses of the 2019 Shanghai Auto Show. Stay tuned for our strategic analysis of the Jetta new brand launch by Volkswagen and exclusive interviews with the Bestune and Jetour teams.

Looked forward to an analysis & perspective of the ultra dynamic Chinese EV frenzy. I am far from disappointed 😉 Great article.

Thank you Rick – there is more to come! So stay tuned…