France Full Year 2018: PSA strong, Dacia overtakes VW, Clio marks 20 years on top, no foreigner in the Top 13 for the first time in 40 years

Another record year for Dacia, now #4 brand in France above VW and placing 2 models in the annual French Top 10 for the first time in history (Sandero and Duster).

Another record year for Dacia, now #4 brand in France above VW and placing 2 models in the annual French Top 10 for the first time in history (Sandero and Duster).

Update 2: Now with the Top 50 Private Sales models

Update 1: Now with the Top 55 All-brands, Top 405 All-models, Top 10 Private Sales, Used cars and Light Commercials data.

Consult over 120 years worth of French Historical Data here.

The French new car market ends 2018 on a 5th straight year-on-year gain at +3% and 2.173.481, the largest annual volume since 2011 (2.204.065). This despite a difficult post-WLTP period that saw deliveries sink 8.5% between September and December, culminating in a 14.5% drop in December also hampered by the yellow vests movement. As a result, although it ranked 4th highest all-time at end-August, the 2018 volume ends up outside the Top 8 all-time annual scores in the whole of French history. Diesel sales have continued to freefall at -15.4% to 844.831 units and 38.9% share, to be compared with 47% in 2017, 52% in 2016, 58% in 2015, 64% in 2014, 67% in 2013 an 73% in 2012. After remaining extremely stable around the 40% mark for the first 9 months of the year, the post-WLTP period was fatal for diesel sales in France: they dropped to a low of 35% share in November. In contrast, petrol sales soar 18.3% to 1.188.172 and 54.7% share vs. 47.6% in 2017 and 43.8% in 2016. Non-rechargeable hybrid sales surge 31.8% to 91.838 units and 4.2% share, pure electric vehicles gain 24.7% to 31.059 and 1.4% but hit a whopping 2.7% share in December thanks to strong Renault Zoe sales, while PHEV sales gain 22.4% to 14.528 and 0.7%, handicapped by the discontinuation of some models after the WLTP transition.

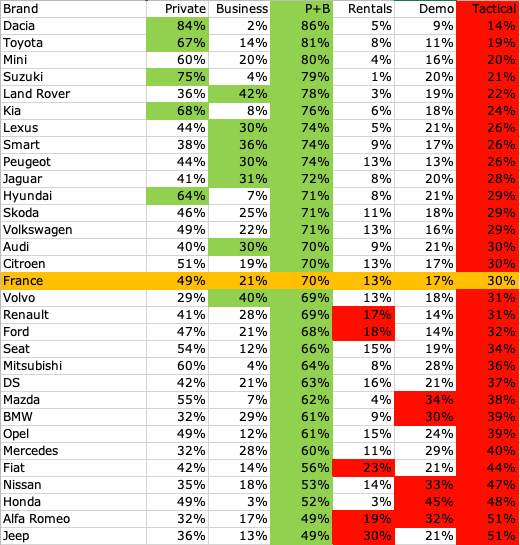

Each Top 30 brand’s sales mix in the “traditional” channels (Private and Business sales) and tactical channels (short-term rentals, demo sales and self-registrations). The green selections are the Top 5 best performing brands in the traditional channels, the red ones are the Top 5 worst performing brands in the tactical channels. An original version of this table was published on largus.fr

Private sales only just edge past the market growth at +3.9% to 1.053.083 units and 48.5% share vs. its lowest-ever score of 47.8% in 2017 and 49.3% in 2016, the last three years being the only ones below 50% in French history. Company sales are stable (+0.4%) at 249.650 units or 11.5% share, while long term leases (+6.1%) double the market growth to hit 9.9% share at 214.045. Total non-tactical sales (the 3 categories above) add up to 1.516.778 or 69.8% share, up 4.1% YoY. As a result, the abhorred tactical sales (+0.4%) have lost a smidge of market share in 2018 at 30.2% vs. 31% last year at 656.703 units. They remain however on a trend up as tactical sales accounted for just 23% of total French sales in 2010 and 28% in 2015. These include short term rentals up a sturdy 7.9% to 246.617 and 11.4% share, demo sales (+0.7%) at 335.706 and 15.5% share thanks notably to a 93% pre-WLTP surge in August and self-registrations down 28.4%. Tactical sales however remain roughly 150.000 units above their natural level: professional website L’Argus.fr estimates the need for rentals and demo cars is around 25% of the annual market instead of the 30% today.

The 3008 has helped Peugeot top the brands ranking 7 times in France in 2018 – a record for the brand.

The 3008 has helped Peugeot top the brands ranking 7 times in France in 2018 – a record for the brand.

Brand sales

French manufacturers (+8.3%) reclaim almost 3 percentage points of market share in 2018 at 57.4% vs. 54.5% last year, whereas foreigners (-3.4%) drop from 45.5% to 42.6%. In the brands ranking, Renault (-2.5%) loses one percentage point of market share to 18.7% but manages to resist an aggressive move by Peugeot (+6.2%) which manages to doubt the market growth to hit 17.9% and topped the brands ranking seven times this year – its highest ever – mainly thanks to the 3008/5008 tandem (+23%) representing 30% of the brand’s sales. Peugeot did take the lead on the private sales channel as we’ll see further down. After a weak 2017, Citroen (+6.2%) manages to slightly improve its share but remains below the symbolic 10% for the third consecutive year at 9.8%. 57% of its volume comes from the C3/C3 Aircross tandem. The main event atop the French brands ranking this year, alongside the strength of Peugeot, is the 4th place of Dacia, surging 19.1% to annihilate its annual volume record in France (and in any single country in the world) to 140.345 vs. 117.874 a year ago which was its previous record. While the low-cost brand has ranked 4th YTD for the most part of the year, a December slump means it ends the year only… 35 units above Volkswagen (+0.7%). Dacia has however ranked higher (#3) with private buyers for a while as we’ll see further down.

Citroen benefits from the first full year of sales of the C3 Aircross.

Citroen benefits from the first full year of sales of the C3 Aircross.

Excellent performance of Toyota (+9.7%) even reaching a record 5th place overall in September and October when VW was reeling from post-WLTP stress, with hybrids up 26% and now representing 69% of its volume. Fiat (+14.7%) is the last Top 10 carmaker to post a gain, with all premium Germans suffering this year: whereas it topped the premium ranks for the past decade, Audi (-21.5%), toppled by Mercedes (-3.2%) in 2017, is now #3 below BMW (-6.2%) due to a poor WLTP transition, something that has also affected Nissan (-16.6%) dropping 58% over the last 4 months of the year. On top of Dacia, 7 additional Top 30 brands break their all-time volume record in 2018, and all bar Jaguar already had a record 2017! These are Kia (+13.6%), Hyundai (+20.2%), Skoda (+17.3%), Mini (+3.6%), Jeep (+21.1%), Lexus (+13.2%) and Jaguar (+29.3%). Mitsubishi (+105.2%), Seat (+26.3%), Volvo (+13.1%) and DS (+12.6%) also fare well while Alpine ends the first full year of its renaissance at #32 with 1.156 sales just below Tesla (-8.5%).

Toyota leaps up 9.7% and broke the monthly Top 5 for the first time in 2018.

Toyota leaps up 9.7% and broke the monthly Top 5 for the first time in 2018.

Brand sales by channel

Now looking at the all-important private sales channel, 2018 was the year of the crowing of Peugeot (+4.7%) at 169.535 sales or 16.1% share vs. 162.640 and 15.4% for Renault (-3.6%) the only Top 10 carmaker losing volume this year. Dacia soars 18.2% to 117.390 private sales and 11.1% share, cementing its third place above Citroen (+16.3%) at 10.4% with Volkswagen at #5 with 68.931 and 6.5% share. Fiat (+26%) and Toyota (+11.4%) also significantly improve their private sales in 2018 while Kia (+15.8%) knocks Nissan (-23%) out of the Top 10. Mercedes (-18%) also tops premium brands with private buyers at 21.148, overtaking Audi (-32%) at 20.722 while BMW remains in third at 18.223. Through a different prism (see table above), the brands with the strongest private mix are Dacia (84%), Suzuki (75%), Kia (68%), Toyota (67%) and Hyundai (64%).

Kia breaks its annual volume record for the 2nd year running.

Kia breaks its annual volume record for the 2nd year running.

Peugeot (+17.2%) also tops the long term leases channel with 54.989 sales and 25.6% share whereas Renault (-4.2%) drops to just 14.9%. Overall, business sales best performers are Land Rover (42%), Volvo (40%) and Smart (36%). Tactical sales have traditionally been a Renault stronghold, as demonstrated with the short term rental channel where Renault (+13.5%) holds 24.5% share with 60.589 sales vs 22% in 2017. Jeep (+53.4%), Seat (+49.2%) and Fiat (+12.5%) have also significantly raised their sales to rental companies. Looking at the sales mix, Jeep (30%), Fiat (23%) and Alfa Romeo (18%) rely the most on short term rentals. But Renault has been strict with demo sales: down 19.1% where Mitsubishi (+69%), Honda (+64.2%) and Nissan (+22.3%) have increased their reliance on this tactic. Overall demo sales “champions” in terms of sales mix are Honda (45%), Mazda (34%), Nissan (33%) and Alfa Romeo (32%).

The Renault Clio has now topped the annual French sales charts 20 times since the nameplate’s original launch in 1990.

The Renault Clio has now topped the annual French sales charts 20 times since the nameplate’s original launch in 1990.

Model sales

The Renault Clio (+5.2%), although due for a new generation this year, manages to double the market growth to reach 5.7% share and the nameplate’s highest volume since 2011. This marks the Clio’s 8th consecutive year at #1 in France, the longest winning streak of any nameplate here since the Renault 5 topped the annual charts for ten straight years from 1974 to 1983. Even more symbolically, 2018 marks the 20th time the Clio has topped annual sales in France in its 29 year-career, the first one was in 1992. Like in 2017, in 2018 the Renault Clio returns an immaculate scorecard, having topped the monthly ranking every single month. The Peugeot 208 (+4.8%) also beats the market, posting its very first six-digit figure sales result but hasn’t ranked #1 monthly since August 2016. The Peugeot 3008 (+14.2%) aligns a second consecutive double-digit gain and podium finish, peaking at #2 for the first time in May, the Citroen C3 (+15.8%) is bolstered by the new generation and gains two spots to #4, the nameplate’s highest ranking at home since 2013 (#3). Note that all 3 aforementioned superminis have aggressively swapped diesel for petrol: petrol sales of the 208 (+25%), Clio (+21%) and C3 (+23%) all surge whereas their diesel registrations all freefall, respectively -37%, -11% and -27%.

The Dacia Sandero remains the #1 vehicle for private buyers, but also breaks into the annual Top 5 for the first time.

The Dacia Sandero remains the #1 vehicle for private buyers, but also breaks into the annual Top 5 for the first time.

More surprising given a new model will be unveiled in a few months, the Dacia Sandero (+14%) breaks into the annual French Top 5 for the very first time, and remains the most popular vehicle outright with private buyers (more details coming shortly). As a result both the Renault Captur (-2%) and Peugeot 2008 (-2.5%) are kicked out of the Top 5 while the Dacia Duster (+38.7%) lodges its 2nd ever annual Top 10 finish after 2011 mainly thanks to – a rarity – its diesel variants up 55% because its petrol versions are penalised with significant malus. This means there are two Dacias in the annual French Top 10 for the first time in history. The Renault Twingo (+18.8%) also makes its return in the Top 10, while the Citroen C3 Aircross (+408.2%) ends its first full year of sales at home at #12 and the Peugeot 5008 (+56.3%) comfortably breaks into the Top 20 at a record #16.

The race for #1 foreigner was very tight: whereas the Toyota Yaris (+16.5% but +31% for its hybrid variant) had taken advantage of VW’s post-WLTP weakness to lead at end-November, the VW Polo (-1.8%) reclaims the title in-extremis, making it 9 consecutive years at the top of the foreign ladder. It is however down one rank on 2017 to #14, and this makes for a historical milestone. 13 French nameplates in the Top 13 is something we haven’t seen in the annual French ranking in just under 40 years, since 1979 when the Top 15 best-sellers were French, the most popular foreigner then being the Golf at #16 and 2% share… The VW T-Roc (#30), DS 7 Crossback (#47) and Seat Arona (#55) also manage very solid scores for their first full year in market. Note the Toyota C-HR (+23.5%) is also enjoying strong hybrid sales (+33%) as do the Auris (+24%) and RAV4 (+21%). In terms of 2018 launches, the Citroen C4 Spacetourer (#54) leads the pack even though it is technically only a rename of the C4 Picasso, distancing the BMW X2 (#101), Volvo XC40 (#111), Peugeot Rifter (#128) and Citroen C5 Aircross (#163) which should climb much higher in 2019, as should the DS 3 Crossback (#263) which landed in December. Other interesting tidbits include 14 Lamborghini Urus, 8 Ford GT and 3 Hyundai Nexo.

The VW Polo is the best-selling foreigner for the 9th straight year but is down one spot to #14 overall.

The VW Polo is the best-selling foreigner for the 9th straight year but is down one spot to #14 overall.

Model sales by channel

Looking at sales by channel, as mentioned above the Dacia Sandero (+12.1%) remains the most popular nameplate with private buyers for the 2nd straight year, distancing the Peugeot 208 (+13.2%) and Renault Clio (+10.4%) just as the Citroen C3 (+17.8%) and Dacia Duster (+43.2%) both step up two spots to #4 and #6 respectively. The Citroen C3 Aircross brilliantly ends its first full year at #9, directly impacting sales of the Peugeot 2008 (-5.7%) and Renault Captur (-11.7%) and the Renault Twingo (+35.6%) knocks the VW Polo (-1.6%) outside the Top 10, meaning the 10 favourite nameplates with French private buyers are all French. And it it managed to claw back to the title of #1 foreigner in the overall ranking, the Polo loses it to the Toyota Yaris (+23) when private buyers are concerned. Further down, the Fiat Panda (+227%), Ford Fiesta (+56%), Kia Picanto (+52%), Citroen C1 (+35%), Opel Corsa (+34%) and Peugeot 108 (+27%) post some of the largest gains. The Toyota C-HR is up to a fantastic 17th spot with 66.2% of private buyers in its mix and the new VW T-Roc (#21) edges past both the Tiguan (#23) and the Golf (#25) for its first full year in market.

The Renault Clio is the best-selling long term lease with 12% share, ahead of the Peugeot 3008 (+32%), Renault Megane (-7%) and Peugeot 308 (+13.6%) while the Peugeot 5008 (+120%) ranks 6th. The best-selling foreigner is the Nissan Qashqai (-15%) at #11. In the business and government channel, the Peugeot 3008 leads above the Peugeot 208, 308, Citroen C3 and Renault Clio in a Top 5 unchanged on 2017. The Peugeot 5008 is #6 ahead of the Renault Megane, the Renault Captur (+69%) leaps up to #9, the VW Tiguan (+19%) remains the #1 foreigner at #10, the Citroen C3 Aircross lands at #13 and the Renault Zoe ranks at a stellar #14.

In terms of tactical sales, the Nissan Qashqai and Fiat 500 earns dubious awards. Demo sales of the Qashqai (+57.6%) send it up to #7 model with 8.106 units, more than its private sales (8.007). The Nissan Juke (+41%) also “shines” in the demo channel with 3.811 units vs. 3.057 private sales. The Fiat 500 (+55%) is #8 demo sale in 2018 (7.472) and #8 short term rental (8.202, +55%), only just below its private sales (8.507, -0.4%). Fiat has also strongly pushed the 500X with rental companies: it ranks #14 with just under 4.000 sales (+68%), the Ford C-Max also being a hit in this channel at 3.047 units (+31%) vs. just 1.088 private sales.

The Renault Megane remains the best-selling under-1-year used car in France.

The Renault Megane remains the best-selling under-1-year used car in France.

Used car sales

Used car sales in France add up to 5.635.358 units, edging down 0.8% year-on-year from the record 2017 tally of 5.678.592. The main destination of the non-WLTP-compliant models rushed into registration in July and August is the “under 1 year” used car sale market, and this can be clearly seen in the end-of-year stats: under 1 year used sales surge in September (+10.8%), October (+16%), November (+17.6%) and December (+18%). As a whole, this segment of the used car market soars 8% in 2018 to 559.467 to reach 10% share, with carmakers such as Nissan (+30.3%), Seat (+38.8%), Skoda (62.7%) and Mercedes (+29%) the most dynamic, a dubious title in the current context. Sales of cars aged 2 to 4 years gain 9.5%, and under-5-years sales gain 7.7% to 2.006 million and 35.6% share vs. 32.8% in 2017. Over-5-years drop 4.8% to 3.629 million and 64.4% share vs. 67.2% a year ago. Back to the total used car market where diesel sales drop 4.3% to 3.509 million while petrol sales gain 2.5% to 1.981 million. French carmakers (-2.9%) lose ground to hold 53% share while foreigners gain +1.7%. As in 2017, we can share with you exclusive used sales models stats for France in 2018. The Renault Clio (-3.4%) stays on top but drops below the 400.000 unit-mark, distancing the Renault Megane (-7.2%), Citroen C3 (+2.1%) and C4 (+1%) both overtaking the Peugeot 206 (-11%). The VW Golf (-2.8%) remains the best-selling foreign nameplate at #6 overall above the VW Polo (#10) and Ford Fiesta (#15). As far as under-1-year sales are concerned, the Renault Megane (-1.7%), Clio (-0.7%) and Captur (+10.5%) means the podium is unchanged on 2017, Peugeot holding the following three spots with the 208 (+5.9%), 308 (-3.1%) and 3008 (+4%). The Fiat 500 (+12.3%) remains the most popular foreigner and breaks into the Top 10, knocking the Renault Kadjar (-11.4%) down to #11 while the Citroen C3 Aircross makes its entrance at #14. The Peugeot 108 (+37.4%), 5008 (+34.6%) and Opel Corsa (+20.5%) register the largest upticks in the Top 20.

The Renault Kangoo marks 21 consecutive years at the #1 LCV in France.

The Renault Kangoo marks 21 consecutive years at the #1 LCV in France.

Light Commercial Vehicle market

LCV sales outpace their Passenger Cars counterparts in 2018 with registrations up 4.7% to 459.126, making France the largest LCV market in Europe once again. Renault (+2.1%) continues to dominate this segment head and shoulders but sees its share thaw for the third year running at 30.7%. In contrast both Peugeot (+6.7%) and Citroen (+5.1%) improve their footprint slightly while Fiat (+4.6%) matches the market at #4. Iveco (+14.7%), Toyota (+12.7%) and Ford (+10.3%) are the most dynamic Top 10 carmakers. Model-wise, the renewal of the Citroen Berlingo this year (sales are split by generation) means Renault now holds the Top 4 spots with the Kangoo (+3.2%) celebrating 21 straight years as the nation’s favourite LCV ahead of the Master (+10.5%), Clio (-9.2%) and Trafic (-0.5%) all gaining one spot as does the Fiat Ducato (-0.8%) at #4 while the Citroen Berlingo (-8.5%) falls three to #6. The Peugeot Boxer (+22.9%), Expert (+20.8%), Citroen Jumpy (+13.7%) and Jumper (+13.4%) shine in the Top 12. Once again the big news are the much-improved pickup sales, led by the Ford Ranger (+17.1%), Toyota Hilux (+4.1%), Nissan NP300 (-0.8%), VW Amarok (+23.3%), Isuzu D-Max (+17.8%), Mitsubishi L200 (+3.9%) and Renault Alaskan (+62.8%) while the Mercedes X-Class soars 146.9% to end its first full year of sales at #72.

Previous post: France December 2018: Yellow vests, post-WLTP send market down 14.5%, Citroen, Seat, Skoda resist

Previous year: France 2017: Clio #1, Peugeot 3008 on podium, Top 12 100% French for 1st time since 1980

Two years ago: France 2016: Private sales under 50% share for the first time in history

Full Year 2018 Top 55 All-brands, Top 405 All-models, Top 50 Private sales, Top 25 LCV brands and Top 100 LCV models vs. Full Year 2017 figures below.

See also the All-time annual volume records for the Top 30 brands, Full Year 2018 Top 20 used cars and under 1-year old used cars vs. Full Year 2017 figures below.