China wholesales April 2022: BYD (+129.2%) shoots up to #1 brand in market hit by Covid lockdowns (-47.6%)

BYD is the best-selling brand in China for the first time.

BYD is the best-selling brand in China for the first time.

Covid lockdowns and associated factory and dealership closures have devastated the Chinese wholesales market in April. According to the China Association of Automobile Manufacturers (CAAM), wholesales are down -47.6% year-on-year this month to just 1.181 million units which is the worst April volume in 10 years. The year-to-date wholesales volume is now down -12.1% to 7,691,000 units. Passenger Cars crumble -43.4% to 965,000 units while Commercial Vehicles implode -60.7% to 216,000 units. In the Passenger Cars detail, Cars are down -39.1% to 461,000 units, SUVs are off -45.6% to 447,000 units, MPVs down -54.6% to 39,000 and minibuses down -55.7% to 18,000. Year-to-date, Passenger Cars drop just -4.2% to 6,510,000 units but Commercial Vehicles sink -39.8% to 1,181,000. In the PC detail, SUVs edge down -3.8% to 3,114,000 units, Cars are down -3% to 3,045,000, MPVs skid -20.8% to 243,000 and minibuses edge up 0.4% to 108,000.

Exports are down -6.6% to 141,000 vehicles including 99,000 Passenger Cars (-15.2%) and 42,000 Commercial vehicles (+23.2%). Year-to-date exports are up 39.4% to 723,000 units. Chinese Passenger Vehicle brands drop “just” -23.3% year-on-year in April to 551,000 units and 57% share compared to just 42.1% a year ago. Year-to-date, the volume of Chinese PC brands is up 9.8% to 3,098,000 and 47.6% share vs. 41.6% over the same period a year ago. New Energy Vehicles ignore the negative context to gain 44.6% year-on-year to 299,000 units, and 112.2% year-to-date to 1,556,000 units. Among Passenger Cars NEV sales (280,000), BEV is up 34.2% to 212,000 and 102.8% YTD to 1,173,000 while PHEV is up 94.1% to 68,000 and 170.3% YTD to 315,000.

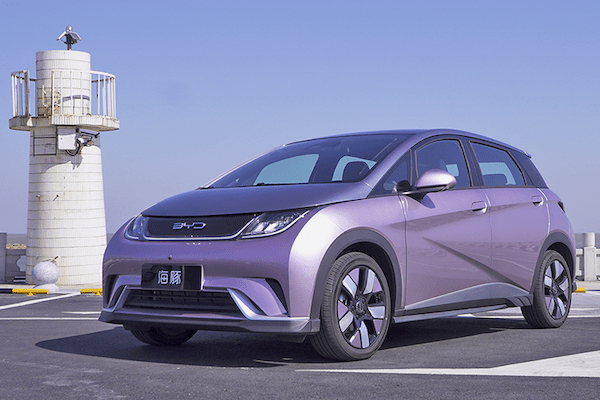

There’s a thunderbolt atop the wholesales brands ranking this month: BYD (+129.2%) goes completely against the market to leap to the overall pole position with over 102,000 sales. BYD topples the traditional leader Volkswagen (-59.7%) which is down to #3 below Toyota (-25.7%). BYD enjoys tremendous success for the Song (+59.5% to a record 25,108 units), Tang (+519.3%), Qin Plus (+293%), Yuan (+153.8%), Han (+64.1%), and the new Dolphin (record 12,040) and Yuan Plus (record 10,100). For its part Toyota has just one winner: the Avalon (+23.4%) with the Camry (-4.5%) also solid but the Japanese carmaker is mostly helped by its new launches: the Front Lander (5,092), Crown Kluger (2,854), Corolla Cross (2,591) and Sienna (4,642). As for Volkswagen, the ID.4 Crozz (+261.5%), Sagitar (+43.2%), T-Roc (+38%) and Golf (+2.4%) are its only comforting results, whereas the T-Cross (-100%), Tacqua (-100%), Magotan (-99.8%), Polo (-99.6%), Phideon (-97.3%) and Tiguan (-97%) all see their output hijacked by factory closures.

The BYD Dolphin breaks into the Top 10 for the first time.

The BYD Dolphin breaks into the Top 10 for the first time.

Changan (-46.9%) follows the market to stay in 4th place overall, distancing Geely (-47.5%) up one spot on last month to #5 whereas Honda (-73.4%) is hit much harder and drops three ranks to #6. Wuling (-38.4%), Chery (-36.5%) and to a lesser extent BMW (-47%) all beat the market in the remainder of the Top 10, the latter gaining 6 spots on March to #10 to outsell Mercedes (-53.2%) and Audi (-79.2%). Dongfeng (-0.9%) is almost stable year-on-year and climbs to #13, while Baojun (-20.2%) for once outpaces its home market and gains 16 spots on last month to #16. COS (-37%) and Lynk & Co (-45.8% and up 7 ranks) also hold relatively well in the remainder of the Top 20. Below, Leap Motor (+228.1% and up to a record #22), Neta (+119.5%) and Xpeng (+74.9%) and TANK (+10.3%) stand out, while further down Geometry (+293.5%), Maple (+652.4%), Lingbao (+158.5%), Haima (+154.6%) and Letin (+67.5%) impress. Notice also Tesla (-94.1%) penalised by the closure of its Shanghai mega factory.

Looking at the models ranking in isolation, the Wuling Hongguang MINI EV (-7.1%) repeats at #1 but still ranks #2 year-to-date below the Nissan Sylphy (-39.5%), #2 in April. The BYD Song (+59.5%) not only breaks its volume record but also its ranking record at #3, becoming the best-selling SUV in the country for the first time. The BYD Qin Plus (+293%) is up seven spots on last month to land at a best-ever 4th place, while the Toyota Levin (-20.3%) is up ten to #5. The Toyota Camry (-4.5%) drops two ranks to #6 ahead of the Haval H6 (-42.2%) at #7. BYD places four nameplates in the Top 10, all breaking their ranking record: the Han (+64.1%) up 27 spots to #8 and the BYD Dolphin up 37 to #10. The VW Sagitar (+43.2%) is also up at #9 overall. Other volume record breakers not mentioned above include the Leap Motor T03 (7,156) and Changan UNI-V (5,426).

Previous month: China wholesales March 2022: Commercial vehicles pull market down -11.7%, Toyota up 10.1%

One year ago: China wholesales April 2021: Honda teases Volkswagen, Changan surges in market up 8.6%

Full April 2022 Top 100 All-brands and Top 440 All-models below.