World June 2020: Shaky recovery continues (-18.1%), 12.5 million sales lost in past 6 months

India is fast becoming the global epicentre of the coronavirus outbreak and some areas are reimposing lockdowns.

India is fast becoming the global epicentre of the coronavirus outbreak and some areas are reimposing lockdowns.

LMC Automotive released its internal Global Light Vehicle (LV) sales for June 2020, showing yet another weak figure but continuing improvement on the lowest pandemic score last April (-44.8%). Global sales are down -18.1% to 6.363.889 units vs. 7.772.783 in June 2019, that’s a loss of 1.4 million units over the month. As a result, the H1 2020 global volume is down -27.7% to 32.609.072 vs. 45.080.575 over the same period in 2019, a staggering loss of 12.5 million vehicles over the past six months. According to LMC, with lockdowns being lifted across much of the world, recovery appears to be underway although a sizeable risk of deterioration remains.

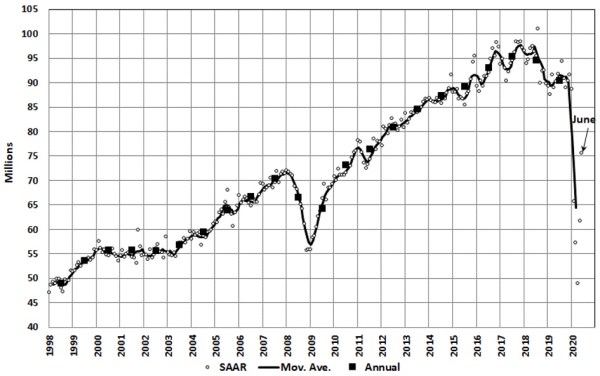

One of the main interests in LMC Automotive reports is the availability of a Seasonally Adjusted Annual Selling Rate (SAAR) for each region. Globally, the SAAR has seen fluctuations not witnessed since World War II over the First Half of 2020: from 88 million in January to 65 million in February, 57 million in March, 49.04 million in April (a 22-year low), 61.25 million in May and 75.6 million in June. This means the June global SAAR is the strongest since Covid-19 started disrupting world sales back in February. The year-to-date global 2020 SAAR now stands at 66.23 million vs. 64.33m last month, down -26.6% on 2019 actuals of 90.32 million. Our Live COVID-19 Dashboard has LMC’s global forecast for 2020 at 71m units, alongside 2020 forecasts for 15 major markets.

Looking at the detail by region, in terms of volume China (+6%) at 2.19m and South Korea (+42.5%) at 0.2m are the only two regions in positive again. As the rest of the world eases lockdowns, China accounts for 34% of world sales in June vs. 41% in May and 49% in April. Eastern Europe (-8.6%) at 0.33m contains its loss thanks to a Turkish surge but Brazil/Argentina (-36.6%) at 0.16m, Western Europe (-26.7%) at 1.13m, the US (-26.2%) at 1.11m, Canada (-23.5%) at 0.14m and Japan (-22.8%) at 0.34m all fall faster than the global rate of -18.1%. According to LMC, US fleet sales implode -68.6% while retail is down -14.2% to its lowest June since 2011. In China, the June SAAR reached 28.8 million, exceeding the pre-COVID-19 crisis level of 26.2 million in Q4 2019.

New daily cases in India. Source Johns Hopkins University

New daily cases in India. Source Johns Hopkins University

What LMC fails to detail is the continued freefalling of India (-47.2%) which has remained the worst performing large market globally in May, something you can easily visualise in our Live COVID-19 Dashboard. At 1.2 million Covid-19 cases officially reported at the time of writing this article, India is now the third most affected country in the world below the US (3.9m) and Brazil (2.16m) but has surpassed Brazil to rank #2 globally over the past week at 257.000 vs. 471.000 in the US. As a result some cities such as Bangalore and states such as Bihar have reimposed lockdowns, and although the Indian market is probably past the worst after a complete stop in April (zero wholesales and retail sales), sales remain very shaky June volumes still only roughly half their year-ago level and the worsening health crisis likely jeopardising any improvement over the next few months.

Previous month: World May 2020: Global sales improve slightly on April at -33.3%

Previous year: World Full Year 2019: Discover the Top 1300 best-selling cars

That Live C-19 Dashboard is an excellent datasource!

Thank you Rick – glad it’s useful to you!