USA March 2020: Sales tumble -39% under COVID-19 pressure, Q1 down -11.9%, Chevrolet Silverado shoots up

Chevrolet Silverado sales are up 25.7% in Q1 in a market down -11.9%.

Chevrolet Silverado sales are up 25.7% in Q1 in a market down -11.9%.

11/04 update: Now with Mercedes, Jaguar and Land Rover data.

March is the month the coronavirus pandemic upended the US economy. From just 100 confirmed cases as of March 1, the number of infected US citizens surged to 188.547 by March 31 (including 3.899 deaths), more than any country in the world and almost double the cases of the 2nd most affected country, Italy (105.792). Worse: only 10 days later and at the time of updating this article on April 10, these numbers were already up to 501.419 and 18.469 deaths. On April 2, White House medical experts forecast that even if Americans hunker down in their homes as told to slow the spread of COVID-19, some 80.000 to 200.000 citizens could die by the time the pandemic is under control. Department of Defence working to provide 100.000 body bags for use by civilian authorities in the coming weeks. Part of the reason behind such a devastating turn of events is the long downplaying of the danger by the government and the absence of united, national response.

US States in lockdown as of April 3. Source Business Insider.

US States in lockdown as of April 3. Source Business Insider.

Each state has operated in a silo but, as of April 2, it is estimated that 96% of the American population is in lockdown with either stay-at-home or shelter-in-place orders valid until end-April and non-essential businesses closed (see map below). On March 19 California, the largest new car market in the U.S., adopted stay-at-home orders, followed by Texas (#2 car market) on March 31 and Floria (#3) on April 1. In major cities where stay-at-home orders were issued, new-vehicle sales typically dropped 80% within a few days according to J.D. Power.The ensuing economic disruption has forced 10 million Americans to file for unemployment in just the last two weeks of the month including 6.6 million in the last week, figures not seen since the Great Depression of 1929, and the current situation means the brunt of the economic impact will be felt in April, May and June. If car servicing and repair is commonly accepted as an essential business, some States including New York (the most affected so far with 3.485 deaths) have lobbied for new car sales to also be deemed as essential business, and won.

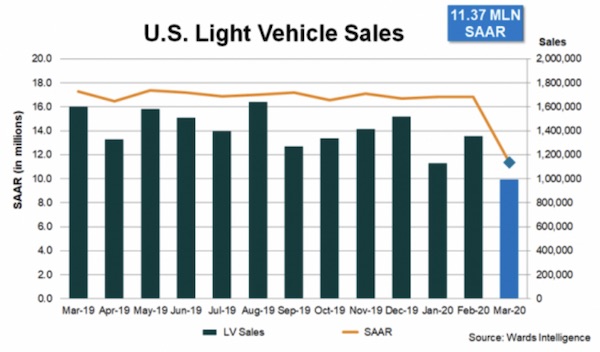

As we anticipated in our mid-month update, this hasn’t prevented the U.S. new car market to collapse in March. The Seasonally Adjusted Annualised sales Rate (SAAR) crumbles -34.7% year-on-year to 11.37 million units, its lowest level since April 2010 at the end of the Financial Crisis (11.25m). Estimates for the April SAAR vary wildly between 5 to 9 million. If February results were on a “Good news only” basis, this time the 11 carmakers that reported detailed March sales average -40.4% with an overall market estimated to fall roughly -39% to 988.000 units. The rest of the market has preferred diluting ghastly March results into more palatable Q1 volumes. Even then, only 3 brands manage to stay positive in Q1: Ram (+2.5%), Lincoln (+2.3%) and Kia (+1%) in an overall market down -11.9% over the first 3 months of 2020 to just 3.512.724 units vs. 3.988.681 a year ago. In March, Hyundai-Kia (-31.2%) and Toyota Motor (-36.9%) fare best among the groups reporting sales, while among brands Kia (-18.6%), Genesis (-33.2%) and Toyota (-35.2%) are the standouts but Mitsubishi (-52.1%), Acura (-51.2%), Honda (-47.7%), Lexus (-46.7%) and Subaru (-47.1%) suffer, the later snapping a streak of 72 consecutive months above 40.000 sales.

Hyundai-Kia is down just -5.4% over Q1 2020.

Hyundai-Kia is down just -5.4% over Q1 2020.

Over the First Quarter of 2020, General Motors (-7.1%) resists ahead of Ford Motor (-10.9%), Toyota Motor (-8.8%) and FCA (-10.4%), all groups outpacing the market itself down -12%. But American Honda (-19.2%) and Nissan Motor/Mitsubishi (-28.1%) both freefall and pull the market down. Mercedes (-4.6%) and Hyundai-Kia (-5.4%) resist best among large groups, with the VW Group (-13.9%) and BMW Group (-17.4%) both in difficulty. Brand-wise, Ford (-13%) falls much faster than Toyota (-7.9%) and Chevrolet (-3.8%) but Honda (-18.9%) and Nissan (-30%) implode. Below Jeep (-14.2%), Ram (+2.5%) and Kia (+1%) are the only gainers in a Top 10 rounded out by Hyundai (-11.3%) and Subaru (-16.7%) down 3 spots on Q1 2019. Further down, Lincoln (+2.3%), Mercedes (-4.3%), Mazda (-4.5%), Chrysler (-4.6%), McLaren (-5.4%), GMC (-5.5%) and Genesis (-5.9%) stand out while Tesla is up an estimated 72.5%.

Ram sales are up 2.5% thanks to the pickup (+7.3%).

Ram sales are up 2.5% thanks to the pickup (+7.3%).

In the models ranking, the Ford F-Series (-13.1%) falls slightly faster than the market due to a very rough March retail performance after gains in January and February. The issue is the two other best-selling large pickups in the US market are on fire: the Chevrolet Silverado (+25.7%) is boosted by a new generation to almost 144.000 units, overtaking the Ram Pickup (+7.3%) and reducing the gap with the F-Series from 100.298 units over Q1 2019 to just 42.863 over Q1 2020… In fact, when adding sales of the GMC Sierra (+30.7%), GM big pickups combined sales hit 198.610 units, higher than any year since 2007 and accounting for 32% of the group’s sales vs. just 23% a year ago. The Toyota RAV4 (+16.5%) also ignores the surrounding gloom to sail off in the distance with just under 98.000 sales vs. 73.500 for the next best SUV, the Chevrolet Equinox (-17%) down one spot to #6. Below the Honda CR-V (-18.4%) also down one tick, the Nissan Rogue (-36.3%) is the big loser in the segment, giving from #4 overall in Q1 2019 to #10 this time.

Lincoln edges up 2.3% in Q1 partly thanks to the new Aviator.

Lincoln edges up 2.3% in Q1 partly thanks to the new Aviator.

The Toyota Camry (-5.5%) brilliantly limits its fall and surges 3 spots on Q1 2019 to #5, more than ever the queen of passenger cars above the Toyota Corolla (-12%) and Honda Civic (-18.2%), now the only sedans in the Top 15. Indeed the next best thing is the Nissan Altima (-8%) at #17 overall just as the Honda Accord (-26.8%) freefalls from #11 to #18. The Ford Transit (+15.7%) and Chevrolet Malibu (+3.2%) manage gains in the remainder of the Top 30 while the Subaru Forester (-3.9%), Ford Edge (-4.3%), Toyota Tacoma (-7.8%), Toyota Highlander (-9%) and Ford Explorer (-9.1%) contain their losses to the single digits. As the Chevrolet Blazer (#42) and Ford Ranger (#47) are now over 1 year-old, there are no recent launches in the Top 60, with the most popular being the Hyundai Palisade (#65) above the Mazda CX-30 (#103), Lincoln Aviator (#127), Cadillac XT6 (#143), Kia Seltos (#144), Mercedes GLB (#148), Hyundai Venue (#177) and Cadillac CT5 (#178). In Q1 we welcome the Tesla Model Y (#224), Porsche Taycan (#246), Cadillac CT4 (#267) and Chevrolet Trailblazer (#276) in the US charts.

Previous post: USA March 2020: Sales down -36% from 15/03 onwards

Previous month: USA February 2020: Only 11 brands report in “Good news only” market, Kia (+20.2%), Mazda (+19%) spectacular

One year ago (March): USA March 2019: Ram (+15.5%), VW (+14.8%), Kia (+10.2%) defy market down -3.1%

One year ago (Q1): USA Q1 2019: Market endures weakest start in 5 years

Full March 2020 selected groups, brands and models below.

Full Q1 2020 Top 15 groups, Top 40 brands and Top 305 All-models below.