Saudi Arabia Full Year 2019: Hyundai Accent and Elantra take control, sales boosted by women (+30.6%)

The arrival of female drivers has boosted the Saudi car market in 2019.

The arrival of female drivers has boosted the Saudi car market in 2019.

Discover 30 years of Saudi Arabia Historical Data here.

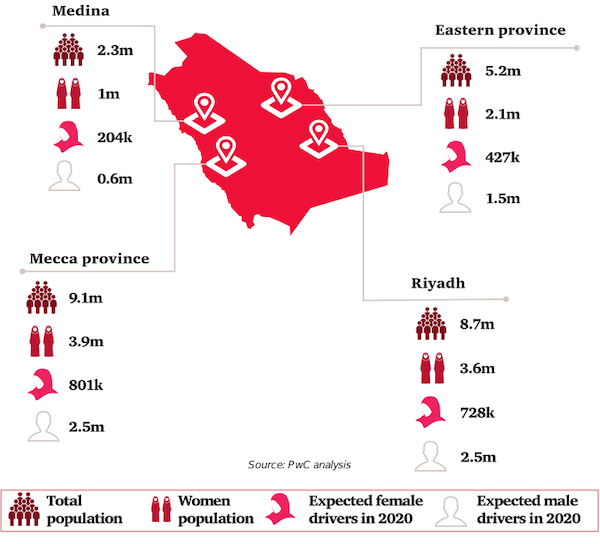

After three consecutive 20%+ annual drops (-21.4% in 2016, -22.3% in 2017 and -23.4% in 2018) resulting in a halving of the market between 2015 (879.704) and 2018 (411.223), the Saudi new car market finally bounces back in 2019, and in a spectacular way: up 30.6% or 126.000 sales to 536.903 units, returning almost exactly to its 2017 score (536.767). The main trigger propping Saudi sales up this year is the arrival of women into the market after the ban on Saudi women driving was lifted on 24 June 2018. Based on market tracking by our Saudi contacts, we estimate that up to 150.000 new driver’s licences have been issued for female drivers as of December 2019, which we estimate translates into 60.000 to 75.000 additional vehicle sales in 2019, or 45% to 60% of the additional volume. A 2018 PwC Middle East report said 3 million Saudi women will drive by 2020 (see chart below), and according to local research agency Kantar TNS 80% of Saudi women – or 12 million – are ultimately likely to try to get their driving licence. We believe these figures will take a little longer to materialise, not because of lack of enthusiasm by female drivers, but rather the infrastructure currently in place to issue new licenses simply cannot keep up with such high pent-up demand.

Saudi Arabia’s opening to international tourism in 2019 has helped car sales.

Saudi Arabia’s opening to international tourism in 2019 has helped car sales.

As a result and as we’ll see below, carmakers whose lineup is attractive to female drivers do best this year. However it is important to notice that other factors are at play in 2019: the arrival of Chinese value-for-money actors such as Changan, spectacularly landing directly into the Top 10 with 2.3% share for its first year in market, as well as MG (+114.3%) up to #11 and Haval who doesn’t disclose Saudi sales just yet, has provided roughly 17.000 additional sales in 2019, or 13% of the additional volume. Finally, Saudi Arabia’s economic recovery coupled with the local government’s spending spree to both modernise the country and create a tourism industry from scratch has also had a significant impact on 2019 new car sales, which we estimate at roughly to 35.000 to 50.000 sales or 30 to 40% of the year’s additional volume.

Changan lands directly at #10 for its first year in market.

Changan lands directly at #10 for its first year in market.

Looking at the brands ranking, Toyota (+14%) hasn’t quite benefited from this year’s market growth and as a result sees its share thaw by four percentage points from 31.7% in 2018 to 27.7% this year. Toyota is now under pressure from Hyundai (+63.3%), the Korean carmaker doubling the market rate to reach 23.2% share vs. 18.6% a year ago. Mazda (+49.7%) also outpaces the market and as a result knocks Nissan (+24.4%) out of the podium. Mitsubishi (+57.3%) and Kia (+41.9%) also advance faster than the market in the remainder of the Top 10 as opposed to Ford (-6.2%), Chevrolet (+11.9%) and Isuzu (+20.8%) but the main event is the arrival of Changan directly at #10. Below, large gains are surprisingly scarce, with Infiniti (+795.8%), Suzuki (+190.9%), MG (+114.3%), Jaguar (+42.6%), Dodge (+37.2%), Ram (+35.8%) and Chrysler (+33.3%) the only additional brands beating the market. In contrast, Honda (-37%), Volvo (-31%) and Renault (-15.1%) implode with the high probability of this being due to lack of stock as their lineup does cater for the new female buyers.

The Hyundai Accent is the best-selling vehicle in Saudi Arabia in 2019.

The Hyundai Accent is the best-selling vehicle in Saudi Arabia in 2019.

Model-wise, the Hyundai Accent (+84.8%) and Elantra (+80.5%) spectacularly take control of the Saudi market this year, the Korean carmaker securing its first ever 1-2 in history and the Accent scoring its 2nd ever pole position after 2016. Leader for the past two years, the Toyota Camry (+22.3%) is relegated to #3 while the Toyota Hilux (-5.6%) is also down two spots to #4. Without falling into blunt stereotypes, it would appear smaller city car sales are notably lifted by the arrival of women on the Saudi market, as illustrated by tremendous gains by the Mitsubishi Attrage (+92.4%), Hyundai Accent (+84.8%), Elantra (+80.5%), Kia Cerato (+72.2%), Nissan Sunny (+60.2%), Chevrolet Spark (+58.3%) and Toyota Yaris (+36.4%), over 5.000 Kia Pegas sold in just four months, earning the title of most popular 2019 launch (#23), and almost 4.000 Changan Eado (#37). The Changan CS75 (#44), CS35 (#54), CS95 (#66) and V7 (#78) also make it into the Top 100.

The Kia Pegas is the most popular 2019 launch: over 5.000 sales in 4 months.

The Kia Pegas is the most popular 2019 launch: over 5.000 sales in 4 months.

January 2005 – December 2019 All-Makes and All-Models monthly data and 1990-2019 All-Makes and All-Models annual data also available. Contact us here for more details

Previous post: Saudi Arabia Q3 2019: Women impact on sales accelerates to +37.8%, Mazda, Changan and MG impress

Previous year: Saudi Arabia Full Year 2018: Toyota Camry repeats at #1, market down 23.4% despite women now able to drive

Two years ago: Saudi Arabia Full Year 2017: Toyota Camry leads for the first time this decade

Full Year 2019 Top 35 All-brands and Top 75 models vs. Full Year 2018 figures below.