Saudi Arabia January-May 2019: Women drive market rebound (+18.9%), Hyundai (+85.6%) places Accent #1 and 3 models in Top 4

The lift of the ban on driver’s licences for Saudi women has boosted new car sales spectacularly this year. Picture Saudi Information Ministry via AP.

The lift of the ban on driver’s licences for Saudi women has boosted new car sales spectacularly this year. Picture Saudi Information Ministry via AP.

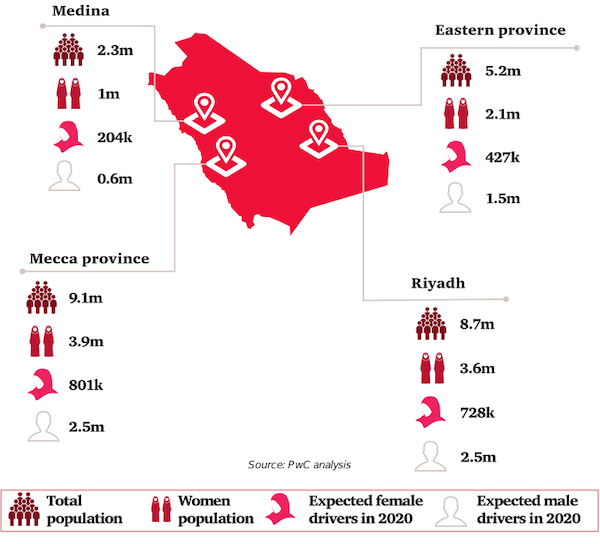

The time has finally come! After imploding 53.2% between 2015 and 2018, including a painful 23.4% last year, new light vehicle sales in Saudi Arabia have bottomed out and are now spectacularly bouncing back up 18.9% over the first 5 months of 2019 to 193.539 units. The big question is: almost one year after the ban on Saudi women driving was lifted (on 24 June 2018), are they the ones responsible for this sudden turnaround? As I detailed in an interview with the BBC.co.uk last year, the effect the arrival of women on the Saudi car market is going to be progressive, but according to our contacts in the Saudi auto industry, a large part of this year’s growth can already be attributed to new women buyers. As of March 2019, 70,000 new driver’s licences had been issued for female drivers. A 2018 PwC Middle East report said 3 million Saudi women will drive by 2020, and 80% of Saudi women – or 12 million – are ultimately likely to try to get their driving licence, according local research agency Kantar TNS.

Expected female drivers population by Saudi region in 2020. Source PwC Middle East

Expected female drivers population by Saudi region in 2020. Source PwC Middle East

As a result, PwC Middle East expects car sales to grow by 9% each year until 2025 as a result of female customers entering the market, and car leasing to grow 4% between 2017 and 2025. Local consultancy Aranca agrees, expecting 8% annual growth by 2022. The arrival of female customers on the Saudi new car market could reshape the sales charts, as their preferences may differ from that of male buyers. 2017 research by Kantar TNS didn’t seem to point at large differences, with the top 5 brands that women aspire to buy being Toyota, Hyundai, Ford and Nissan, BMW topping the premium segment. However 2019 sales data shows there are already massive changes at play in the Saudi new car market.

Changan is already a Top 10 brand in Saudi Arabia.

Changan is already a Top 10 brand in Saudi Arabia.

Indeed manufacturers are affected very differently this year. Brand leader Toyota (-2.2%) is totally missing out on the market rebound, posting the worst performance in the Top 12, and now threatened by Hyundai surging 85.6% to 23.5% of the Saudi market vs. just 15% a year ago and 25.4% for Toyota. Mazda (+25.5%) continues its very impressive progression, dislodging Nissan (-1.1%) to step onto the podium for the first time. Mitsubishi (+56.2%) and Kia (+27.8%) also vastly outpace the market in the Top 10, with Isuzu (+8.1%) and Chevrolet (+7.5%) up but losing share and Ford (-0.9%) and Nissan (-1.1%) in decline. The big surprise is Chinese manufacturer Changan landing directly at #10 with more than 4.000 sales over the period: although the brand launched in 2016 in the region, it has only started sharing official data. Below, MG (+165.3%), Suzuki (+160.8%), Peugeot (+114.1%), Geely (+94.8%), Jeep (+93.6%), Lexus (+44.8%) and GMC (+36.8%) all post fantastic scores in the Top 25.

The Hyundai Accent is the best-selling vehicle in Saudi Arabia so far in 2019. Picture motoringme.com

The Hyundai Accent is the best-selling vehicle in Saudi Arabia so far in 2019. Picture motoringme.com

Model-wise, Hyundai suddenly holds an iron grip on the charts, with 3 models in the Top 4. The Accent (+144.4%), lifted by a new generation and a potential high attractiveness with female buyers, topples the Toyota Camry (+22.1%) for pole position, with the Hyundai Elantra (+62.4%) and Sonata (+23.8%) in tow and the Toyota Hilux (-20.7%) rounding up the Top 5. The only other Top 10 model outpacing the market is the Mazda CX-9 (+48.9%) up 5 spots year-on-year to #10. The Hyundai Tucson (+200.6%), Kia Rio (+125.5%), Kia Cerato (+116.3%) and Mitsubishi Attrage (+79.7%) also shine in the Top 25. The Hyundai Kona (#24) is the most popular new launch with just under 1.900 sales and 1% share, distancing the Changan CS75 (#40), Changan Eado (#47), Toyota Rush (#49), MG6 (#54), Changan CS95 (#55), Toyota Ace (#59) and Changan CS35 (#62).

January 2005 – May 2019 All-Makes and All-Models monthly data and 1990 – 2018 All-Makes and All-Models annual data also available for Saudi Arabia. Contact us here for more details

Previous post: Saudi Arabia Full Year 2018: Toyota Camry repeats at #1, market down -23.4% despite women now able to drive

One year ago: Saudi Arabia First Half 2018: Market sinks -25%, women a glimmer of hope

Full January-May 2019 Top 35 All-brands and Top 70 models below.