China retail March 2022: BYD (+232.3%) on podium for first time, Tesla (+87.9%) shines in market off -15.2%

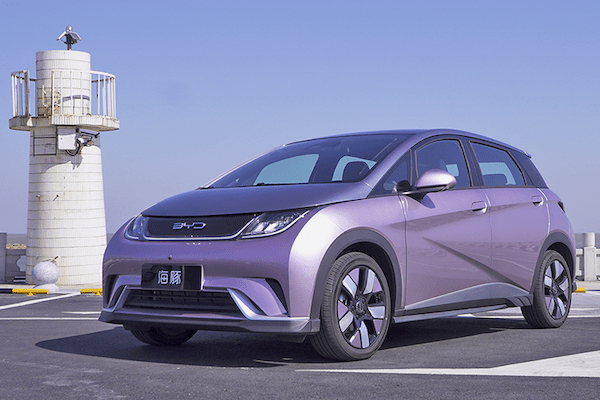

The new Dolphin helps BYD to its first podium finish at home.

The new Dolphin helps BYD to its first podium finish at home.

It’s 3 negative months out of 3 this year with the Chinese retail market accelerating its fall in March to -15.2% and 1,428,040 units for the selection of vehicles included in this report, leading to a Q1 2022 tally off -8.8% to 4,739,695. BSCB is the only non-Chinese medium to cover both wholesales (ex-factory shipments) and retail sales data for China so you can get the most complete picture of the largest new car market in the world. Retail sales tend to give a more authentic idea of the market as they roughly correspond to registrations by end-customers and are more difficult to artificially boost with exports which can sometimes be the case for wholesales data. Note pickups and medium to heavy commercial vehicles are not included in this dataset, but it includes a more detailed split by model variant (Jetour X70, X70 Coupe, X70 Plus, X70M and X70S for example).

Brand leader Volkswagen (-39.8%) delivers another very disappointing performance and sees its advantage with the #2-ranked brand (Toyota) thaw to just 8,820 units. It looks like the microchip crisis is still wreaking havoc for the German manufacturer. Abysmal performances by the T-Cross (-66.7%), Bora (-65.5%), Tacqua (-60.5%) Phideon (-55.8%), Magotan (-54.7%), Santana (-53.7%), Sagitar (-51.9%) are too much to be balanced off by the slew of new ID. BEVs launched by the brand over the past year and totalling 10,630 units for the month or 7.6% of VW’s sales in March. Toyota (-1.5%) is almost stable which is quite a feat in the current context. It is helped by strong showings by the Wildlander (+55.1%) and Camry (+29.3%) as well as a list of successful launches: the Front Lander (record 7,215 sales), Sienna (record 6,568), Crown Kluger (record 5,036), Corolla Cross (record 4,490) and Harrier (3,577).

Geometry breaks its all-time volume record in March to 7,019 units.

Geometry breaks its all-time volume record in March to 7,019 units.

BYD (+232.3%) continues on its spectacular run, more than tripling its March 2021 volume and overtaking Honda to sign its first ever podium finish at home at #3. BYD is helped by tremendous performances by the Dolphin (record 10,202), Yuan Plus (record 7,438), Qin Plus (+3464.3%), Song Plus (+724.6%), Yuan (+713.4%) e3 (+474.1%), Tang (+274.8%) and Han (+75.3%). Honda (-20.8%) falls faster than the market at #4, distancing Wuling (-1.8%) almost stable. Tesla (+87.9%) forges ahead and climbs 10 spots on February to reach a record 6th place, well above its premium competitors Mercedes (-22.4%), Audi (-32.8%) and BMW (-34.9%) and this with only two models. Nissan (-39.2%), Geely (-30.2%) and Changan (-31%) all suffer in the remainder of the Top 10.

Below, GAC (+36.7%) and Chery (+26.6%) go against the market with splendid upticks just as Haval (-47.3%) and Buick (-40.9%) freefall. Two EV start-ups break their ranking record this month: Xpeng (+226.1%) up to #20 and Ora (+6.7%) at #21. They both outsell such established brands as Hyundai and Chevrolet. Further down and in order of sales, LI (+119%), Neta (+337.7%), NIO (+42.2%), Leap Motor (+281.1%), Venucia (+37.5%) and Geometry (+444.1% to a record 7,019 sales) make themselves noticed. Weltmeister (+212.2%) also breaks its volume record at 5,516.

The Tesla Model Y is up to #2 overall in China in March.

The Tesla Model Y is up to #2 overall in China in March.

Looking at the models ranking, the Wuling Hongguang Mini EV (+41.7%) cements its leadership and is now also #1 year-to-date. The Tesla Model Y (+288.1%) confirms once again that it is the new favourite SUV in China, while the Nissan Sylphy (-32.3%) remains in third place. The Model 3 (+5.1%) makes it two Teslas in the Top 4 for the first time. The BYD Qin Plus and Song Plus complete the Top 6 like last month. The Haval H6, traditionally the best-selling SUV in China, endures a dramatic fall at -49.7% year-on-year to #14 overall and #4 SUV for the month as the Toyota Corolla (-44.2%) continues to suffer also. The best-selling new launch is the BYD Dolphin at #31 with a record 10,202 sales ahead of the Chery QQ Ice Cream at #33 with a record 10,090 units, the GAC NE Aion Y (#56) and the BYD Yuan Plus at #57 with a record 7,438 units. Another nameplate breaking its monthly volume record in March is the Xpeng P7 (9,168).

Previous month: China retail February 2022: Wuling (+25.8%), BYD (+192.9%) can’t prevent market down a surprising -9%

Previous year: China retail Full Year 2021: Wuling, BYD show explosive growth in market up 6.4%

Full March 2022 Top 123 All-brands and Top XXX All-models below.